AUSTRALIA: Queensland based rail freight operator Aurizon has reached agreement to acquire One Rail Australia from funds managed by Macquarie Asset Management. Subject to regulatory approval, the A$2·35bn deal announced on October 22 is expected to be completed by April 2022.

ORA is the former Genesee & Wyoming Australia business, which was spun off to Macquarie Infrastructure & Real Assets and PGGM in 2019 as part of the takeover of Genesee & Wyoming Inc by Brookfield Infrastructure and GIC.

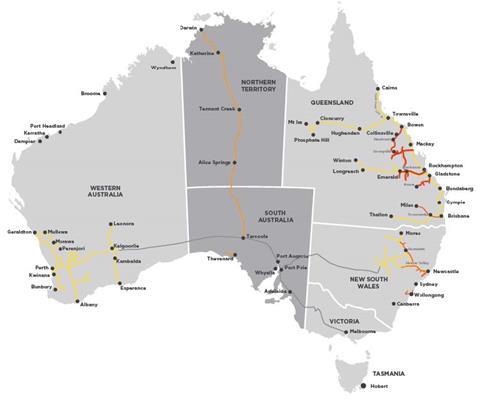

The railway operates and maintains the 2 200 km Tarcoola – Alice Springs – Darwin line linking South Australia and Northern Territory under a long lease, and also manages regional rail infrastructure in South Australia where it provides bulk haulage and general freight services. Its East Coast Rail business unit operates open access services in New South Wales and Queensland, including a long-term haulage contract with Glencore serving mines in the Hunter Valley coalfield until 2036.

Aurizon described ORA as ‘a strong, profitable business’ with an estimated EBITDA of A$220m for the 2021 calendar year. Of this, the Bulk business is expected to contribute A$80m and ECR around A$140m.

Divestment commitment

Announced in a filing to the Australian Securities Exchange, the transaction is subject to regulatory consent and other closing conditions, including clearance from the Australian Competition & Consumer Commission. The acquisition will be fully funded from a combination of Aurizon’s existing debt facilities and underwritten by new committed debt.

Aurizon intends to retain and integrate ORA’s bulk and general freight assets, including five yards, 68 active locomotives and more than 1 000 wagons, along with approximately 400 employees.

To address potential competition concerns, Aurizon said it would be committing to ‘an enforceable undertaking with the ACCC’ to divest ECR through a demerger or trade sale, ‘whichever creates greater value for Aurizon shareholders’. Its aim is to complete this divestment by the end of 2022. Until that time, ECR would be operated independently from the Aurizon Group with its own CEO and management team.

Strategic and transformative

‘The One Rail acquisition is highly strategic and transformative for Aurizon’, explained Managing Director & CEO Andrew Harding, adding that the transaction offered a ‘unique opportunity’ to grow the business and create value for shareholders. ‘It is fully aligned with Aurizon’s strategy to grow our Bulk freight business into new markets and new geographies in Australia.

‘At our Investor Strategy Day in June, we detailed our aspiration to double our earnings in the Bulk business over the coming decade. The One Rail acquisition delivers a step change for Aurizon Bulk as a new entrant in the SA and NT region, and supports the ongoing growth of non-coal revenue in the Aurizon portfolio. Upon completion of the transaction, with the integration of One Rail bulk and divestment of ECR, the Bulk share of Aurizon’s haulage revenue will represent around 40%.

‘The ORA bulk infrastructure and operations in SA and NT provide customers with a safe, efficient and effective pathway to market for numerous existing commodities and growth opportunities in base metals, agriculture, iron ore and for new-economy metals such as manganese and copper.’