UK: The National Audit Office has published a financial overview of the railway system in England, setting out how much it costs and how it is paid for.

NAO said its aim was to ‘enhance clarity’ at a moment of ‘significant industry change’; the report also highlights some of the challenges ahead.

The auditors noted that the arrangements for delivering rail services in the UK are ‘complex and distributed across the public and private sector’, which ‘makes it difficult for Parliament and taxpayers to understand the overall financial position, to which the taxpayer is ultimately exposed, and the impact of government’s choices’.

The overview examines income and expenditure for the five years to March 2020, largely though analysis of published data. It only covers England, reflecting devolution in Scotland, Wales and Northern Ireland.

The analysis covers Network Rail, franchised and non-franchised passenger operators, freight operators and High Speed 1, but does not include the financing of new infrastructure, such as High Speed 2 or Crossrail, or major enhancements such as electrification or the Trans-Pennine Upgrade, which are now funded outside the regular regulatory regime.

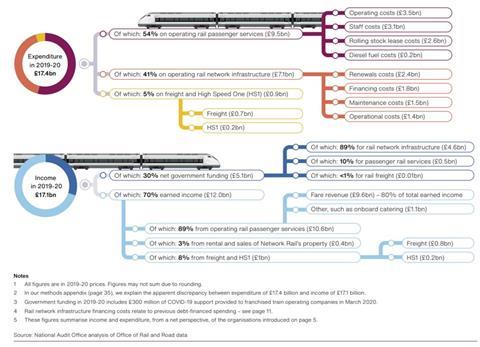

The £17·4bn total expenditure in England for the 2019-20 financial year included £9·5bn spent on operating rail passenger services, £7·1bn on infrastructure, £0·7bn on operating freight services and £0·2bn on operating High Speed 1.

Total rail sector income in the same year was £17·1bn, of which 30% was government funding and 70% was earned. Of the earned income, 80% came from fares. Of the government funding, 89% supported the operation, maintenance and renewal of infrastructure by Network Rail and 10% of government funding supported passenger services. ‘Internal’ financial flows within the rail sector, such as the payment of track access charges, were excluded as these did not impact on the overall income and expenditure.

The report reviews the effects of the Covid-19 on railway finances and explains the resulting changes to the structure of the industry through emergency contractual agreements. It then considers the wider future challenges faced by the rail sector, and notes that a white paper addressing the recommendations of the Williams Review is now expected in May.

Supporting documents

Click link to download and view these filesA financial overview of the rail system in England

PDF, Size 2.52 mb