While implementing the investment plan, Centralny Port Komunikacyjny (CPK) not only cooperates extensively with science but also creates and develops its own tools necessary for forecasting domestic and international traffic.

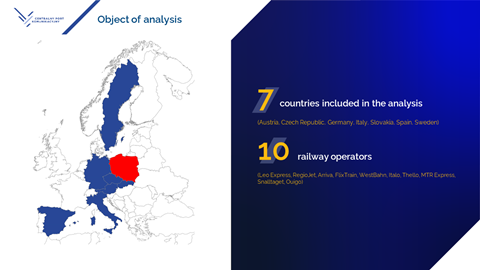

With a view to preparing a solid basis for traffic forecasts, CPK experts analysed the transport offer of “open access” operators in selected European countries, together with an assessment of their potential in Poland. The report “Analysis of offers of open access operators in chosen European countries with an estimate of their potential offer in Poland”, developed on this basis summarises the experience to date of European Union countries in liberalising rail passenger transport and forecasts what will happen to Polish railways in the coming years, following the entry of other railway operators and the successful commissioning of new high-speed railway lines.

Changes in access to the Polish railway infrastructure were initiated by the adoption of the ‘4th Railway Package’, i.e., solutions aimed at unifying railway services across the European Union.

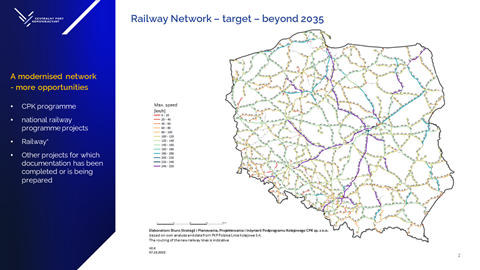

“The construction of the High-Speed Railway is an opportunity to change the image of railways in Poland. CMK Północ, i.e., the extension of the Central Railway Main Line to Gdańsk, or the construction of the “Y” line, i.e., the new line between Warsaw, Łódź, Wrocław and Poznań, will make it possible to offer travel times that are competitive with road transport as well as air transport,” says Bartłomiej Morga, a railway specialist at CPK and the main author of the report. “This report is an attempt to answer questions about what challenges the railway industry may face in the coming years, and at the same time it is an analytical basis which can be used to develop a target model for the organisation of transport in Poland.”

The liberalisation of the Polish railway market, the opening of HSR lines and the possibility of separating part of the traffic should lead to a clear increase in the use of railway transport. Thanks to competition among railway operators, there will be a reduction in ticket prices, which will have a very positive impact on the number of passengers, although the scale of that effect in Poland depends on a number of other factors described in the report. Considering EU commitments, the complete liberalisation of the railway market in Poland should take place by 2030.

This CPK report is the first such comprehensive material on the liberalisation of the railway sector in Poland. The first part of the almost 250-page document contains an analysis of the experience of seven foreign markets: Germany, Sweden, the Czech Republic, Slovakia, Austria, Italy and Spain. The authors analysed the individual European countries in terms of the layout of railway connections, transport policies or barriers for operators.