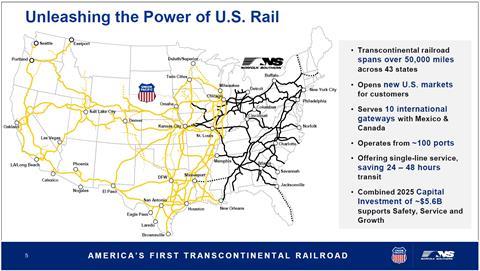

USA: Union Pacific Corp has set out details of its agreement to acquire Norfolk Southern Corp to create the USA’s ‘first transcontinental railroad’ from coast-to-coast. UP said that combining the two networks serving the west and east of the country would ‘seamlessly connect’ over 80 000 route-km across 43 states.

The 72% stock and 28% cash transaction would be funded through cash on hand and new debt, implying an enterprise value of $85bn for Norfolk Southern.

The boards of both companies have unanimously approved the deal, which remains subject to regulatory and shareholder approval.

The combined business would retain the Union Pacific name and headquarters in Omaha. Norfolk Southern’s Atlanta headquarters would remain a core location, with a focus on technology, operations and innovation.

Union Pacific Chief Executive Jim Vena is to lead the combined company as CEO and has stated his intent to remain at the company for at least the next five years.

At closing, three Norfolk Southern Directors, including Mark George and Richard Anderson, are expected to join the Union Pacific board.

Synergies of $2·75bn

In a joint investor conference call on July 29 the two railways said the combined company would be able to provide faster and more reliable transit times, more comprehensive services and a more seamless customer experience. These goals would be achieved by reducing distances, eliminating interchange delays and offering new routes in the Ohio Valley and Mississippi watershed area.

This would make the US rail network more competitive against trucks, ‘reducing wear-and-tear on taxpayer-funded roads’, and also compete more effectively with Canadian railways ‘to win back US freight volume and American jobs’.

The railways expect the deal to unlock $1·75bn in annualised revenue synergies and $1·0bn in cost synergies, and to ‘transform the US supply chain, unleash the industrial strength of American manufacturing and create new sources of economic growth’.

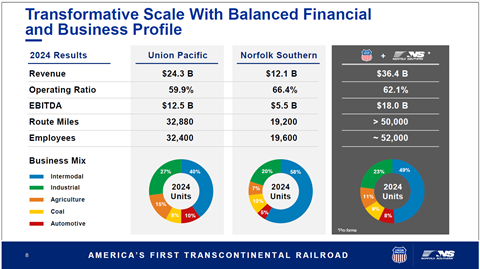

Based on 2024 results, the combined company would have revenues of approximately $3bn, EBITDA of approximately $18bn, an operating ratio of 62%, and free cash flow of $7bn.

Workforce impact

The railways said they intend to grow the business to create additional employment opportunities. Every union employee who wants a job in the combined company would have one, and non-union workers would have opportunities as part of a larger business.

There will be some consolidation of overlapping functions in corporate roles. As an end-to-end combination there is little overlap of locations, and workforce reductions resulting from productivity initiatives would be managed by attrition.

Completion in early 2027

The transaction is subject to approval by Union Pacific and Norfolk Southern shareholders, and approval from the Surface Transportation Board and other regulatory authorities.The companies said they believe the deal is ‘overwhelmingly in the public interest’. They expect to file their application with STB within six months and hope to close the transaction by early 2027.

The management teams will continue to independently run each company until the transaction’s closing.

The agreement is structured without a voting trust. Union Pacific would pay a $2·5bn reverse termination fee if the deal does not go ahead.

Vena said ‘this combination is transformational, enhancing the best freight transportation system in the world – it’s a win for the American economy, it’s a win for our customers, and it’s a win for our people’.